Published July 11, 2025 | Category: Investing

For real estate investors in Almería, long-term rentals offer lower risk and more stable net returns. Holiday rentals may outperform in tourist hotspots — but only with excellent occupancy, management and legal compliance.

Investing in Almería Property

1. Investment models explained

Real estate investors in Almería typically choose between two models:

- Long-term rental — stable monthly income, minimal turnover, low management.

- Holiday rental — high nightly rates, seasonal peaks, high turnover and regulation.

2. Financial comparison: Which model yields better returns?

| Metric | Long-term rental | Holiday rental |

|---|---|---|

| Monthly income | €700 avg. | €90 per night |

| Occupancy rate | 95%+ (year-round) | 150 nights/year avg. |

| Gross yearly revenue | €8,400 | €13,500 |

| Costs (platform, cleaning, utilities) | Low | High |

| Who pays utilities? | Tenant | Owner |

| Net yearly income | ~€7,800 | €8,000–€9,000 |

| Net yield (on €150,000 property) | ~5.2% | ~5.5–6% (best case) |

Conclusion: Holiday rentals may beat long-term yield only in high-performing cases. Otherwise, long-term is more consistent and less volatile.

3. Legal and operational risks

| Risk / Requirement | Long-term | Holiday rental |

|---|---|---|

| Tourist licence | Not required | Mandatory (Junta de Andalucía) |

| Platform commissions | None | 10–20% |

| Owner management | Minimal | High (unless outsourced) |

| Seasonal fluctuation | None | Strong |

| Eviction risk | Moderate | None (short stays) |

| Fines for non-compliance | Unlikely | Yes, if unregistered |

Note that short-term lets and flexible rental models sometimes tempt owners or tenants to consider subletting — especially if the property is vacant during low season or while searching for buyers. However, subletting is heavily regulated in Spain and can lead to serious penalties if done without the proper legal framework.

Learn more in our full guide: Is Subletting Legal in Spain?

4. Where each model works best in Almería

| Location | Best investment model | Why |

|---|---|---|

| Mojácar Playa | Holiday rental | High tourist traffic |

| Almería city | Long-term rental | Expats, students, stable demand |

| Vera Playa | Holiday rental | Tourism niche (e.g. naturism) |

| Roquetas de Mar | Mixed | Year-round + seasonal visitors |

| Huércal de Almería | Long-term rental | Residential, no tourist flow |

5. Investor recommendations

If you’re investing for **passive income and low effort**, long-term rentals offer the best balance of return and security — especially inland or in residential areas.

If your goal is **maximum return from seasonal demand**, and you’re prepared to manage bookings, cleaning and licensing, then a holiday rental in Mojácar, Vera or San José might outperform.

Keep in mind that **net yield**, not just gross income, should drive your decision. Holiday lets often incur 2–3× more in operating costs.

6. Final verdict

Both long-term and holiday rentals in Almería can offer attractive returns — but the right choice depends entirely on your goals as an investor, the location of your property, and how actively you want to be involved.

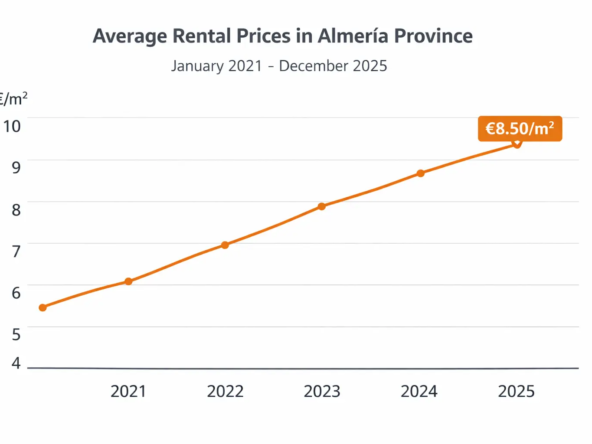

Long-term rental is often the safer bet for those looking for predictable income and less day-to-day hassle. It typically delivers a net yield of around 5–5.5%, with fewer regulatory hurdles and lower costs.

Holiday rentals can outperform — but only under the right conditions: high demand, strong occupancy, and good management. The risks and workload are significantly higher, and income is more volatile.

Note: All figures in this article are cautious estimates based on market averages in 2025. Your actual results will depend on local factors, pricing strategy, and how efficiently the property is managed.

If you’re considering investing in Almería property and want to weigh your options, it’s worth speaking to a local advisor or property manager before committing to a strategy, or youi can contact us for advice

More like this: Real Estate & Economy.