Published July 17, 2025 | Category: Market Trends

Almería Property Listings in Q2 2025: Supply Hits New Lows – Market Faces Tight Supply

The number of Almería property listings has experienced a dramatic shift in the second quarter of 2025. According to property portal Idealista and several national property reports, the amount of homes listed for sale in the province fell by 22% compared to the same quarter last year. This marks one of the sharpest quarterly declines on record and reflects a broader nationwide trend, as listings across Spain dropped by approximately 20% year-on-year.

If you’re looking for our current listings in the area, click here to browse available properties.

What’s causing the decline in available housing?

Several structural and short-term factors are contributing to the shortage of property listings in Almería:

- Underbuilding: Spain faces a long-standing housing deficit of between 450,000 and 600,000 units. New residential development continues to fall short of demand, particularly outside major urban hubs.

- Permit delays: Building permits in many Andalusian municipalities can take over a year to process, deterring developers from launching new projects.

- Tourist rental shift: A growing number of owners are withdrawing properties from the sales market in favour of short-term rentals, particularly in high-demand beach areas.

- Selective development strategy: Builders increasingly focus on luxury or second-home developments, leaving fewer mid-range or starter homes available for local residents and first-time buyers.

The AVE factor: rising pressure around Vera and Mojácar

A major additional driver of local housing scarcity — particularly in coastal and eastern zones of the province — is the anticipated arrival of Spain’s AVE high-speed rail network in Almería. The long-awaited expansion is expected to connect the province to Madrid and other major cities via a new station in Vera, projected to open by 2027–2028.

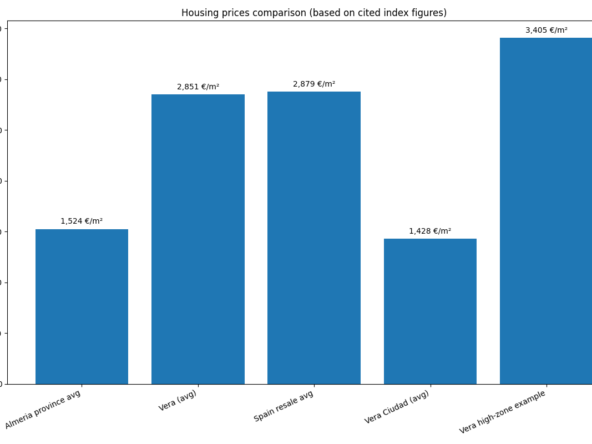

This infrastructure project is already impacting buyer behaviour. Early investor activity has increased in areas such as Vera Playa, Mojácar, Valle del Este, and Cuevas del Almanzora. Developers in Vera estimate that properties within 15 minutes of the new AVE station could see price increases of up to 30% by completion.

Recent data reflects this momentum. In Mojácar Playa (Ventanicas-El Cantal), sale prices reached €3,022/m² in June 2025 — a year-on-year rise of 34%. For detailed projections and pricing analysis, visit our Almería Property Prices page.

What does this mean for buyers?

As Almería property listings shrink and demand intensifies, buyers face a more competitive environment. Properties in popular coastal locations are now attracting multiple offers within days. Foreign buyers — especially those relocating, retiring, or investing — are advised to secure financing early and move quickly when suitable homes become available.

Expectations of future AVE-linked appreciation are also shifting buyer focus eastward, creating increased interest in towns that were previously considered more peripheral.

Rental market under strain

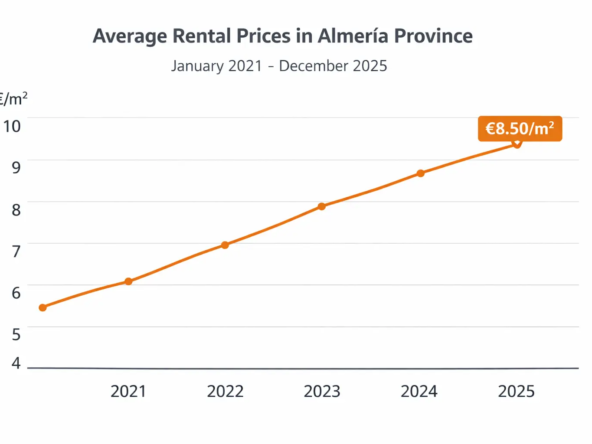

The long-term rental market is facing parallel pressures. Since 2020, Spain’s rental housing stock has fallen by over 50%, while average rental prices have risen by more than 30%. In Andalusia, rents rose by 11.1% in early 2025, with Almería’s increase averaging 3.5% year-on-year.

Competition for rentals is particularly strong in beach towns and provincial centres. Tenants are advised to act swiftly and be flexible in terms of location and budget.

Investment outlook: risk and opportunity

For investors, the current conditions present both challenges and potential. On the one hand, rising acquisition costs and regulatory tightening (especially in the tourist sector) demand careful planning. On the other, price appreciation and long-term rental demand offer attractive returns — particularly in undervalued inland areas or coastal zones near upcoming infrastructure.

For a broader view of investment trends and demand hotspots, see our feature on the Almería Property Boom.

How should local authorities respond?

Experts and housing advocates continue to call for reforms aimed at increasing supply and reducing pressure:

- Streamlining the building permit process

- Expanding public housing initiatives

- Offering renovation incentives and subsidies

- Discouraging long-term vacancies and land speculation

Final thoughts

The 22% drop in Almería property listings is not just a temporary blip — it reflects a deeper imbalance between supply and demand. While Almería’s natural appeal continues to draw buyers from across Europe, structural challenges in the real estate sector require both policy response and strategic investment.

If you’re considering buying or investing in Almería, timing and insight are critical. Focus on value zones with future infrastructure links, secure legal and financing support early, and stay informed about the fast-evolving market landscape.

This article is for informational purposes only and does not constitute legal or investment advice. For personalised guidance, please contact us.