Published January 5, 2026 | Category: Real Estate

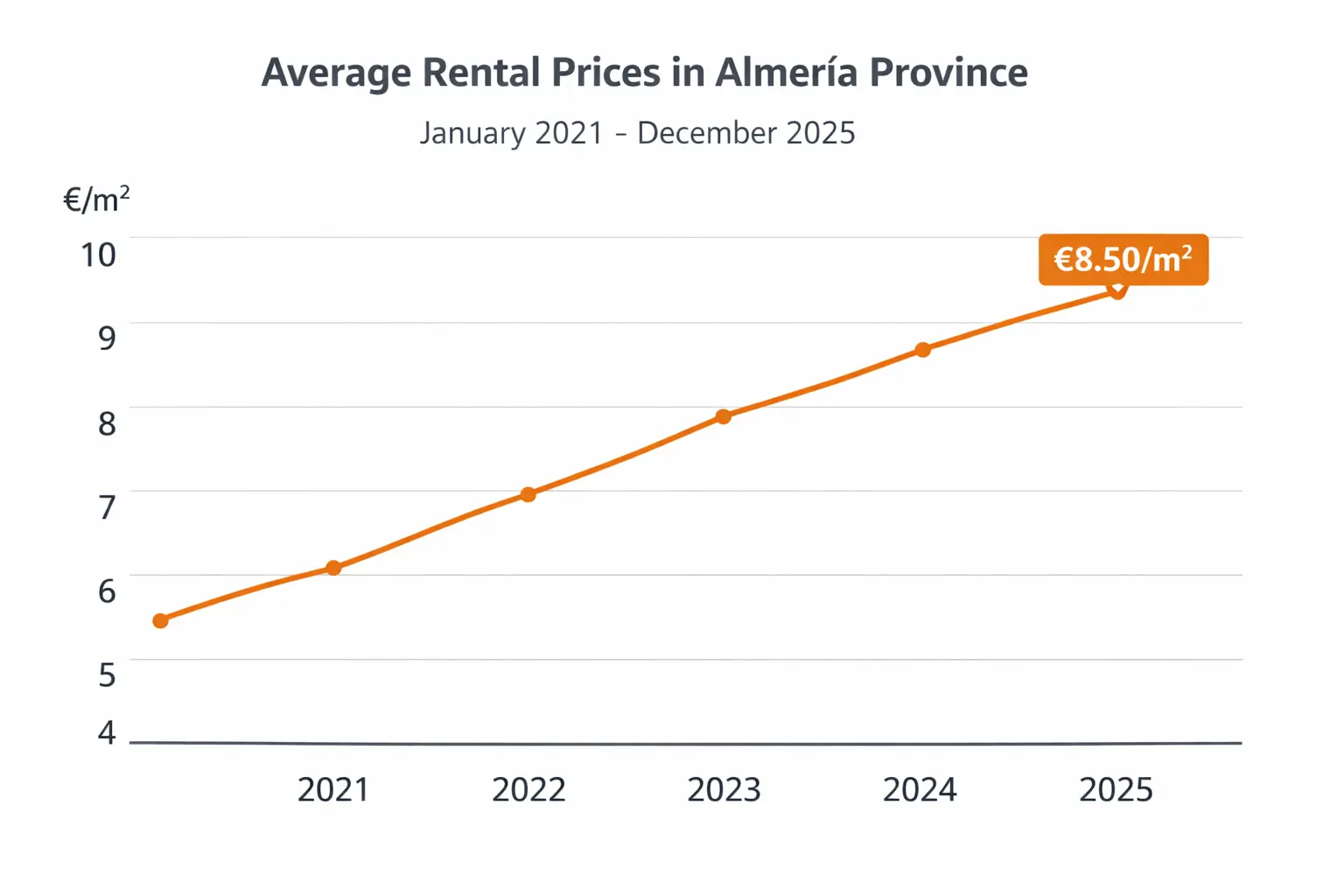

TL;DR: Long-term Almería rental prices closed 2025 at record highs, averaging around €8.50/m² (+7.5% year-on-year). Price pressure is no longer limited to the capital, with coastal and commuter municipalities also reaching new peaks, while demand increasingly spills into inland areas.

Almería rental prices close 2025 at record levels

Market overview

According to year-end figures published by Idealista, the average long-term rental price in the province of Almería stood at approximately €8.50 per square metre in December 2025. This represents a 7.5% increase year-on-year, confirming that rents have reached their highest levels since records began for this dataset.

While asking prices do not reflect every signed contract, portal data remains a useful indicator of market direction. In Almería, the signal is consistent: limited supply, high competition for well-located properties, and increasing selectivity by landlords.

Where rents are rising fastest

The most notable development is that record prices are no longer confined to Almería city. Several municipalities that traditionally offered relative affordability have now reached historic highs. Vera closed the year at around €8.80/m², while Vícar reached approximately €8.40/m². Even Carboneras, long considered more accessible, is now close to €7.00/m².

In larger population centres, growth has been steadier but persistent. Roquetas de Mar approaches €8.40/m², while El Ejido averages roughly €7.40/m². In practice, these figures often understate the difficulty faced by tenants, as the best-priced listings tend to disappear rapidly.

Almería city: a segmented market

Within the city of Almería, the rental market is increasingly divided by neighbourhood. Areas such as Vega de Acá, Nueva Almería and Cortijo Grande have become the most expensive zones in the province, with asking prices frequently exceeding €10.30/m². Family-sized apartments in these districts commonly surpass €1,000 per month.

Low tenant turnover and risk-averse landlord behaviour have sharply reduced available stock in these neighbourhoods. As a result, access is effectively restricted to households with higher incomes or stronger financial guarantees.

At the same time, districts such as El Zapillo and parts of the historic centre face a different dynamic. There, the expansion of short-term tourist rentals has reduced the supply of long-term housing, intensifying competition and pushing prices higher even for modest properties.

Pressure moves inland

As coastal and urban rents rise, demand is increasingly shifting towards the interior of the province and the Almanzora Valley. Towns such as Macael, Olula del Río, Cantoria and Tíjola have seen notable increases in asking rents, driven by a combination of local employment demand and households priced out of coastal areas.

This spillover effect suggests that inland markets are no longer functioning as a low-cost fallback. Instead, they are becoming part of a single, interconnected provincial rental system, where pressure in one area quickly transmits to another.

Outlook for 2026

Some analysts suggest that Almería rental prices may be approaching a psychological ceiling, as tenant budgets are increasingly stretched. However, a slowdown in growth should not be confused with a correction. Without meaningful increases in long-term rental supply, prices are more likely to stabilise at elevated levels than to decline.

Industry sources continue to point to structural issues: vacant homes kept off the market, limited new rental-focused development, and regulatory uncertainty around short-term lets. Together, these factors imply that access to affordable long-term housing will remain constrained throughout 2026.

Conclusion

The record rents recorded across Almería at the end of 2025 confirm a rental market under sustained pressure. What was once a challenge concentrated in the capital has become a province-wide issue, affecting coastal towns, commuter areas and increasingly the interior.

For tenants, the market demands realism and preparation. For investors and property owners, it highlights a context of strong demand but also growing social and political sensitivity around housing access. As 2026 unfolds, the key question will not be whether rents remain high, but whether meaningful supply can be brought back into the long-term market.

Considering buying or investing in Almería? Contact Almería Housing for realistic guidance based on local market conditions.