Published January 9, 2026 | Real Estate & Economy

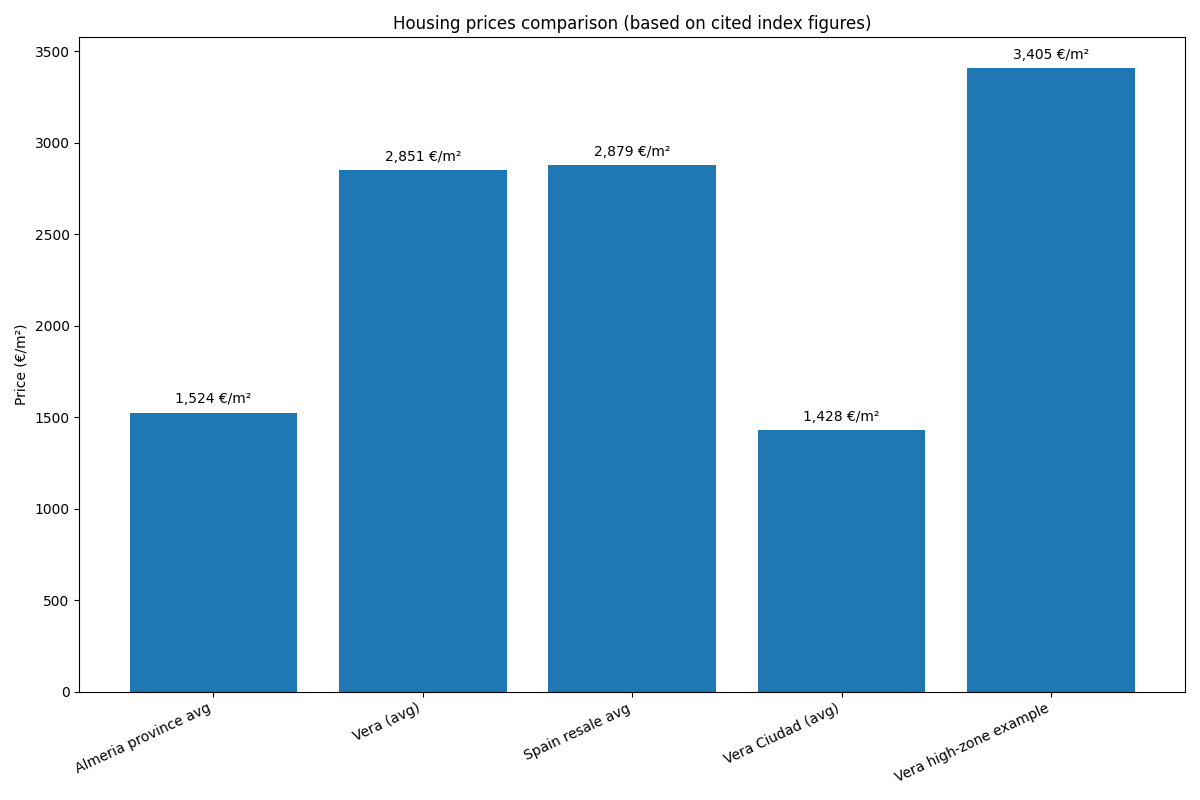

TL;DR: Resale prices in Almeria’s tourist towns are jumping fast, and Vera is the standout example. Fotocasa’s data points to a sharp year-on-year rise (reported as +62%), while its December 2025 index places Vera at around €2,851/m² on average. Population growth (now just over 20,000 residents officially) adds pressure, but the bigger story is structural: Spain’s housing market is still defined by a demand–supply mismatch.

Housing prices surge in Almeria’s tourist towns, with Vera reportedly up 62% in a year

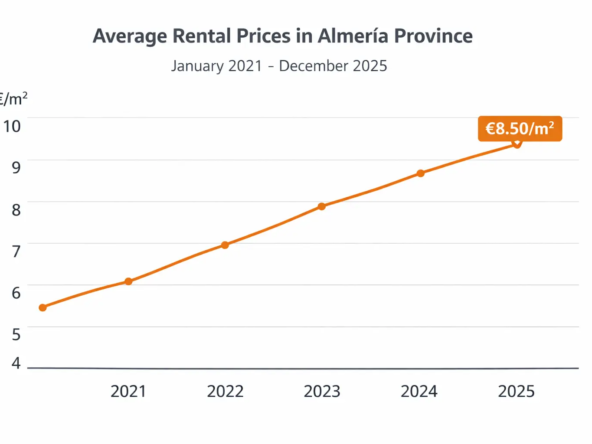

Housing prices in Almeria’s coastal and tourist municipalities have been moving in one direction: up. The sharpest changes are being seen in the Levante area, where Vera has become a headline case. According to data from the Fotocasa Real Estate Index, the town has recorded the largest increase in the cost of resale housing among Almeria’s tourist localities, reported as a 62% rise year-on-year.

That percentage is attention-grabbing, but it only makes sense when you put it beside what buyers actually face on the ground: the current price level, the speed of demographic growth, and the limited supply in the kinds of areas people most want to buy in.

What the current numbers say about Vera

Fotocasa’s own local index for Vera (December 2025) places the municipality at an average of €2,851 per square meter, with an estimated average property value around €239,958. That is an average across the municipality, not a promise that every street or development trades at the same level. You can see the details here: Fotocasa price index for Vera.

Even within Fotocasa’s breakdown, the spread is clear. District-level data shows Vera Ciudad at roughly €1,428/m², while coastal and expansion areas cluster much higher (and some zones are listed above €3,000/m²). In plain English: the “average” can hide the fact that the most wanted parts of Vera are pulling away fast.

Vera’s population has crossed 20,000 — officially

Demand is not just a vibe; Vera has been growing in a measurable way. The official municipal register revision (“Padrón”) confirms Vera’s population at 20,282 residents as of January 1, 2025, based on the Instituto Nacional de Estadística. The INE provides official municipal figures here: INE – official population by municipality.

Crossing the 20,000 mark matters for more than headlines. It reflects sustained household growth and a larger base of people competing for housing — whether as full-time residents, second-home owners, or investors. In a market where supply doesn’t expand at the same pace, pressure builds quickly.

National context: Spain closed 2025 with record resale growth

Vera’s jump sits inside a much bigger national upswing. Fotocasa reports that Spain’s resale housing market closed 2025 with an annual increase of 20.5%, placing the national resale price at €2,879/m² in December 2025 — the strongest annual rise in Fotocasa’s series. Source: Fotocasa press release (Jan 2026).

Fotocasa’s explanation is blunt and consistent with what many buyers feel: demand is outstripping supply. In that same release, the company’s spokesperson attributes the surge to demand effectively “quadrupling” available supply, alongside structural shifts such as household formation and preference changes (bigger homes, better locations, more amenities).

Why tourist towns can move faster than the rest

Tourist municipalities behave differently from inland markets. They don’t rely on just one type of buyer. A coastal town can have year-round local demand, seasonal second-home demand, retirement demand, and investor demand — and those groups are not always competing for the same property type, but they do compete for the same limited land, the same “good” locations, and the same finished stock.

In places like Vera, a large share of interest concentrates in a few predictable segments: well-located apartments with terraces, parking, pools, and proximity to beaches or golf developments. When many buyers target the same “wish list,” prices can lift quickly even if the broader municipality still includes cheaper pockets.

New-build vs resale: why “even higher” is plausible

Your original note that new-build prices can land above resale is not controversial — it’s typical in many Spanish markets, especially where buildable land is constrained and construction costs have risen. The Spanish housing market has also shown ongoing strength in new-build pricing in multiple datasets, even while resale moves more erratically depending on local stock.

For broader market tracking beyond portals, one useful reference point is the official Housing Price Index (IPV) from Spain’s statistical authority. In the third quarter of 2025, the INE reported a national annual change of 12.8% (with different rates for new vs used housing). Source: INE – Housing Price Index (IPV), Q3 2025.

What this means for buyers in Vera right now

If you’re shopping in Vera today, the practical takeaway is simple: price expectations based on “last year” may already be obsolete. A fast-moving market does two things at once: it increases the number of sellers who feel confident pricing high, and it pushes hesitant buyers to act faster (which can reinforce the cycle).

That doesn’t mean every listing is correctly priced — overheated markets also produce optimistic asking prices — but it does mean buyers need a tighter process: define your non-negotiables, understand micro-locations, and be realistic about what budget buys in the zones with the strongest demand.

What this means for owners and sellers

For owners, the headline figures can be tempting. But a high-growth market is not just an opportunity; it’s also a filter. Properties that match current buyer preferences (condition, efficiency, outdoor space, parking, walkability) tend to sell first and justify higher numbers. Homes that need work or sit in less desired pockets can lag even while the “average” rises.

If you’re thinking of selling, the real advantage is not “pricing to the moon.” It’s knowing where your property sits in the local hierarchy and pricing so it attracts serious buyers rather than months of low-quality inquiries.

The bigger picture: demand, supply, and why it’s not quickly fixed

Even if the pace of growth cools, the underlying imbalance remains the core issue. The Bank of Spain has repeatedly flagged housing market dynamics as a key area to watch, including how price growth interacts with supply constraints and affordability. And the Spanish Land Registrars’ statistics provide another lens on prices and activity using registry-based data.

In other words: Vera’s “62%” is the local spike that grabs attention, but the forces behind it — limited stock in desirable coastal markets, rising household formation, and persistent demand — are not unique to Vera. That’s why tourist towns often lead the move, and why the correction (if it comes) is rarely quick or clean.

Have questions about housing prices or the local market in Almeria? Visit the contact page to get in touch with us.